In October, stock “short sellers” – investors who bet on the likelihood that stocks will decline in value – published misleading and inaccurate reports about “parked” .com domain names and how those domain names would be affected by ongoing changes to Google AdSense. We believe that the short sellers hoped to profit by declines in our stock price due to the false information they published. While we explained the inaccuracy of these reports at the time of their publication based on historical data, we now have a growing body of publicly available data that empirically refutes the short sellers’ predictions.

Before we review the data, let’s recall what the short sellers said. One of the most dramatic predictions was that 30 percent of the .com domain name base was “at risk of churning” in the next 12 months, as a result of Google AdSense changes. For perspective, 30 percent would equate to “churn” of about 48 million .com domain names. As we noted in October, parked domain names for which the registrant is primarily attempting to monetize traffic with website advertising represent less than two percent of the .com domain name base (as opposed to the 30 percent imagined by short sellers), a percentage that has been declining for more than a decade when Google AdSense changes first began, even as the .com domain name base has steadily grown.

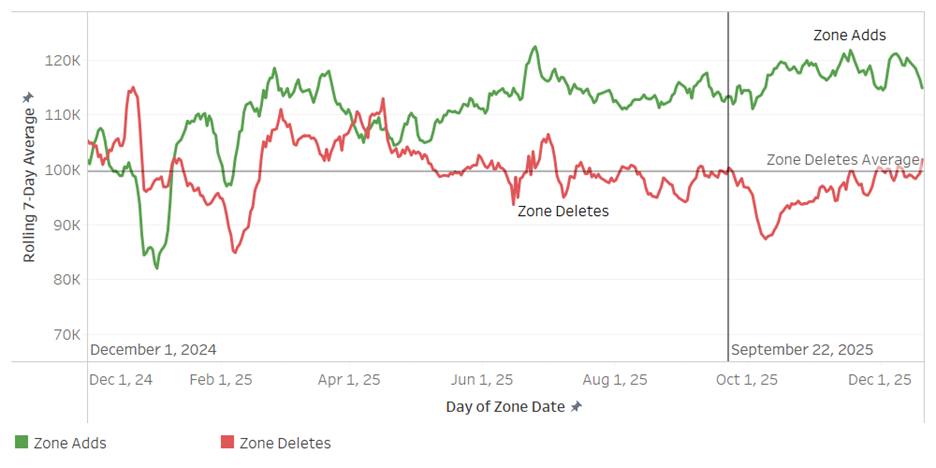

We can now compare publicly available zone data to the short seller predictions. If there existed a “Short Sellers’ Cohort” of about 48 million domain names deleting between late September 2025 – when monetization platforms reported significant impact from the latest Google AdSense changes – and September 2026, we’d expect the .com zone to lose 131,506 domain names per day, above and beyond normal fluctuations we see with the registration and deletion of domain names.

Most domain names have one-year registration terms, which means that since Oct. 1, 2025, nearly a quarter of all .com domain names have reached the end of their terms and were either renewed or deleted, so if the Google AdSense changes represented, as short sellers suggested – a precipitating event for the deletion of a massive number of domain names – we’d expect those deletions to begin right away. We know these Google AdSense changes caused turmoil in recent months among the small group of companies that depended on Google AdSense revenue for parked domain names, so if they were going to impact the .com domain name base significantly, as short sellers predicted, we would expect the effects to be visible right away, and certainly within three months.

Does the zone data reveal evidence of this massive negative impact to the COM zone? No.

The following charts reflect an analysis of publicly available data from ICANN’s Centralized Zone Data Service (CZDS):

COM Zone Changes 7-Day Average1

The chart shows a seven-day rolling average for COM zone data for the past 12 months. The flat line in the graph shows the average number of zone deletions for the year, and the vertical line notes the time in September when the latest Google AdSense impacts were reported. The data does not show any incremental increase in the number of deletions. Based on this data alone, the Short Sellers’ Cohort of about 48 million “churn” domain names simply cannot exist.

In addition to the zone data, each month ICANN publishes registration and deletion data for all gTLDs including .com, 90-days after it is received. While the September data won’t be publicly available until next month, it should mirror what we are seeing in the publicly available zone data, which is to say, the non-existence of a Short Sellers’ Cohort of about 48 million “at risk” .com domain names.

The clarity of this publicly available data refutes the short sellers’ flawed thesis they propagated in October. We hope that when stakeholders read reports by short sellers, they do so with a clear understanding of the financial motivations that can influence their predictions, and a clear memory of their flawed analysis of the impact on .com from the Google AdSense changes.

- The rate of .com domain name turnover remains largely steady over time, consistent with a renewal rate that has been between 73%-75% since 2017. Renewal rates for first-time domain name registrations are lower than those for domain names that have been renewed more than once, contributing to relatively minor variations in that range over time. ↩︎